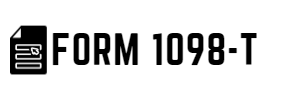

Tax Form 1098-T: Tuition Statement

1098-T Student Tax Form: Instruction for 2023

This tax document is issued to students by their universities and colleges. IRS Form 1098-T for 2023 reports payments received for qualified tuition and related expenses. The sample includes the training, fees, scholarships received, and any prior year’s tuition adjustments. Students use this form to claim the American Opportunity Credit or the Lifetime Learning Credit, which reduces their federal tax liability.

Our website form1098t.net is an invaluable online resource for those handling the document. We provide helpful instructions, examples for completing the printable 1098-T tax form for 2023, and explanations of various educational credits. The website also links other helpful resources to make filing taxes easier. Additionally, we offer a free fillable 1098-T form for 2023, which can be completed and printed as needed. A website is an essential tool for anyone filing the template, as it provides step-by-step instructions to ensure the copy is completed accurately and completely. With the help of the website, taxpayers can be confident that they are taking advantage of all the tax credits they are eligible for.

The 1098-T Tax Form Target Group

Anyone enrolled for at least half of the year in an educational institution or program eligible to participate in a US Department of Education student aid program must file Form 1098-T: Tuition Statement with the IRS.

For example, John is a 32 years old aspiring web developer who lives in Los Angeles, California. He's been enrolled in a coding boot camp since September 2023 and has a part-time software developer job. Because of that, he must fill out the 1098-T form. The template is available online or in print. The IRS website provides a blank example with instructions on filling it out, a sample PDF and a printable version. John has to fill out a copy with information regarding his tuition payments, scholarships, and other related expenses. The document must be submitted before April 15, 2024.

John is familiar with filing the college tax form 1098-T, as he's done it before. He knows that his tuition expenses and scholarships are eligible for benefits and credits, so he takes the necessary steps to file the template. He takes time to complete the copy appropriately and submits it on time. This way, John can take advantage of the tax benefits and credits he is eligible for.

If a student receives a scholarship or grant that is not used for qualified tuition and related expenses, the excess amount might be reported as miscellaneous income on Form 1099-MISC. This could happen if, for example, the scholarship covers not only tuition but also living expenses. To get more instructions and file 1099 electronically, follow the link from our website.

There are several befits that a person might receive after filing the document:

Form 1098-T Filing Instruction for Students

Filling out IRS Form 1098-T PDF correctly is essential for filing taxes in the USA. This form reports college tuition payments to the Internal Revenue Service (IRS). To ensure your information is accurate and complete, here is a guide on filling out Form 1098T with instructions for 2023:

- Find the proper template: it’s available in print and online (in PDF format) for the last tax year. You need to choose the version depending on how you want to file the copy.

- Enter your personal information: You must provide your name, address, and Social Security or Tax Identification Number.

- Provide information about the educational institution: You must include the name, address, and EIN (Employer Identification Number) of the school or college you attended in the 2023 tax year.

- Enter payment information: Include the total tuition and expenses you paid during the tax year.

- Complete other sections: If applicable, you should also fill in any other sections regarding scholarships, grants, and other financial aid forms.

- Finish the copy completion: Once you have filled in all the information, print it, sign it, and submit it to the IRS.

If you have any questions or need help filling out the blank 1098-T form, refer to the official IRS instructions or seek advice from a tax professional.

Pay attention to the other forms with a similar purpose and might be helpful:

IRS Penalization System

The Internal Revenue Service (IRS) can impose a penalty of up to $500 for failing to file the 1098-T form example. If the IRS discovers you have provided false information on the copy, you can be charged with perjury and face criminal penalties. In addition, you may also need to pay interest on any taxes you owe due to filing the copy late or inaccurately.

Preparing and submitting your 1098-T form template on time is essential to avoid consequences. Pay attention to the due date and provide the most accurate information possible to ensure the best outcome. Failure to do so could result in hefty fines and penalties from the IRS.

Date to File Form 1098-T

The due date is on April 15th of each year for individuals filing taxes in the United States. This document is necessary to file taxes if you are a college student and have received scholarships, grants, or other tuition payments during the year. Failing to file the 1098-T form or providing false information can result in severe penalties and fees.

More About Tuition Statement 1098-T Form

College Tax Form 1098-T: Helpful Materials

Please Note

This website (form1098t.net) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.