Form 1098-T Download

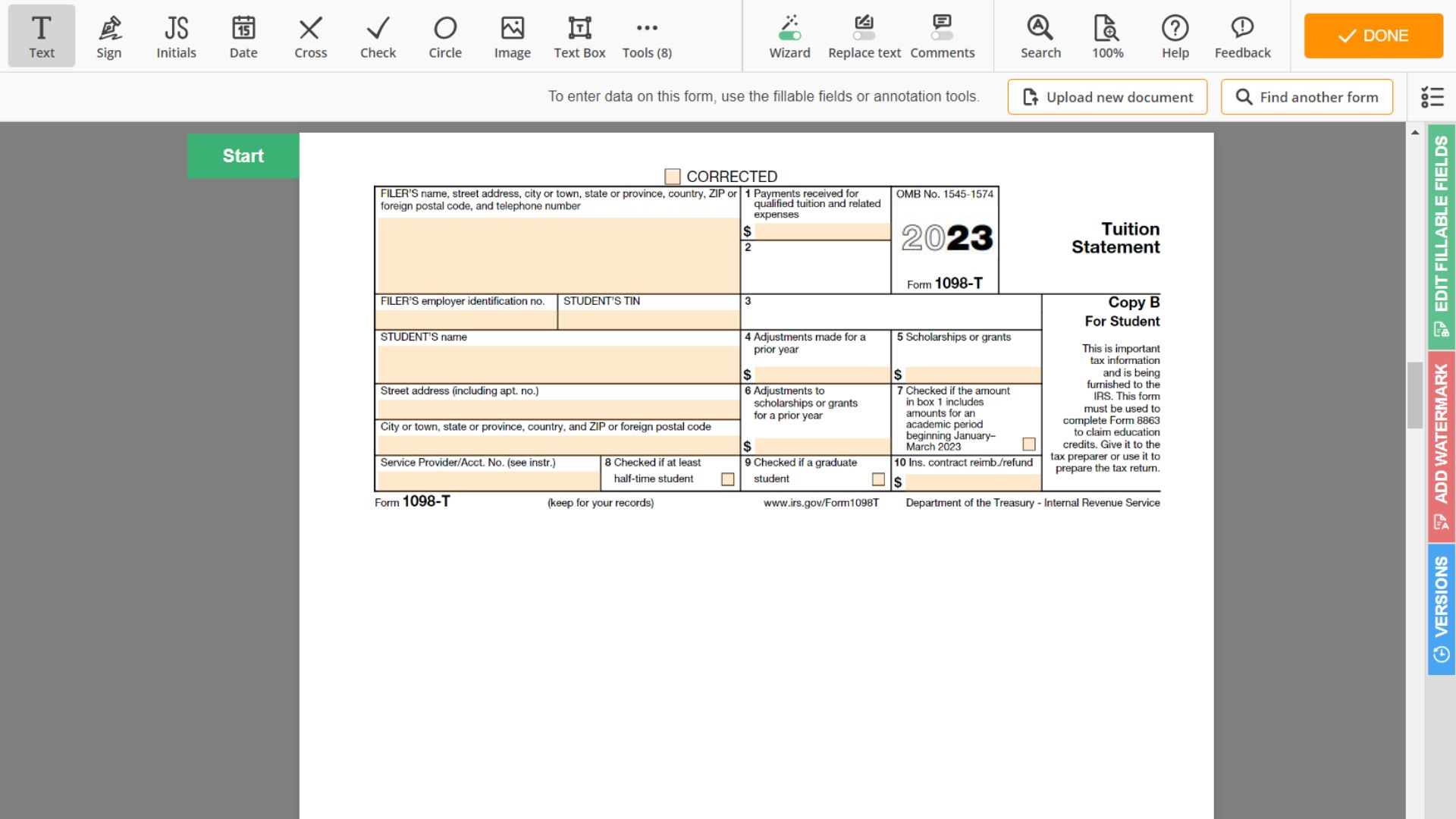

The IRS 1098-T form is important for students who paid for qualified tuition and related expenses in the past tax year. Federal form 1098-T is provided by educational institutions and reports the amount of qualified tuition and related expenses the student pays. It also includes any scholarships or grants the student receives that can be used to offset the tuition paid.

The information on the 1098-T form is crucial because it can help the student or their parents claim education-related tax credits, such as the American Opportunity Tax Credit (AOTC) or Lifetime Learning Credit (LLC). These credits can help reduce the amount of tax owed or even provide a refund.

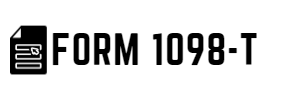

1098-T Statement Filling Guide

To complete the 1098-T form, you must obtain it from your educational institution. Most schools provide this form electronically through an online portal, while some may send it through the mail.

Once you have the blank example, review it carefully to ensure all the information is correct. If there are any discrepancies, contact your school's financial aid office immediately to have them corrected.

Next, you must provide the requested information on the 1098-T copy. This includes your name, address, Social Security number or taxpayer identification number, and the amounts paid for qualified tuition and/or related expenses.

This information would also be included on the template if you received any scholarships or grants. Review this section carefully, as scholarships and grants may affect your eligibility for education-related tax credits.

Common Mistakes Students Make Completing the 1098-T Form

Completing the 1098-T template can be confusing, and people make several common mistakes. These mistakes can lead to errors on the sample, resulting in taxpayers not receiving the full tax credits they are entitled to. Some common mistakes include:

- Failing to report all qualified tuition and related expenses paid

- Reporting the amount billed rather than the amount paid

- Failing to report scholarships or grants received

- Reporting scholarships or grants as taxable income when they are not

- Failing to include the taxpayer identification number or Social Security number

Possible Penalties

Failing to file the 1098-T form or providing false information on the sample can result in penalties from the IRS. If you fail to file the copy, you may be subject to a penalty of $50 per form, up to a maximum of $550,000. If you provide false data on the completed sample, you may be subject to a fine of $270 per copy, up to a maximum of $3,339,000.

In addition to penalties, failing to report about scholarships or grants received or failure to report all qualified tuition and related expenses paid can result in the taxpayer not receiving the total amount of tax credits they are entitled to. This can result in owing more taxes or missing out on a refund.